Medicare’s Income Related Monthly Adjustment Amount (IRMAA) is a surcharge on top Medicare Part B and Part D premiums for Medicare beneficiaries who have generated too much income, but how is IRMAA determined?

How is IRMAA determined?

The simplest answer is your income.

The Centers for Medicare/Medicaid Services (CMS), which administers Medicare, receives from the IRS every 1 to 3 years, your tax returns to determine how much income you have earned.

If your income exceeds certain levels, you will be placed in a corresponding IRMAA bracket and charged accordingly to that bracket the next year.

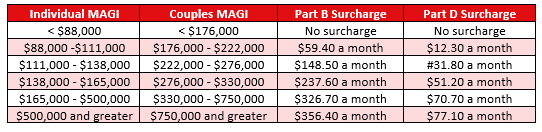

The IRMAA brackets and surcharges in 2021 are:

What is the income that CMS uses for IRMAA?

CMS defines income as “adjusted gross income plus any tax-exempt interest” or for the tax year 2020, everything on lines 2b and 11 of the IRS form 1040.

Some examples of the income that is included on those two lines are: Wages, Social Security benefits, Capital Gains, Dividends, Pension and or Rental Income, Interest, and any distribution from any tax-deferred investment like a Traditional 401(k) or Traditional IRA.

Where it may get complicated:

Again, CMS receives from the IRS your tax returns every 1 to 3 years to determine IRMAA and is backwards looking. If you retire in 2022, CMS may not look at your 2021 tax return, which will help you avoid IRMAA that year, but it may look at your income in 2022 for the year 2023.

If you happen to reach IRMAA in any given year you will be notified by the Social Security Administration. The notification will provide your income, the IRMAA surcharge and how the surcharges will impact your Social Security benefit.

Please note that if you are receiving Social Security benefits these surcharges will automatically be deducted from any benefit you are receiving.