If you are enrolled in Medicare, about to enroll in Medicare, or are helping someone enroll in Medicare, you may be aware of the dreaded IRMAA surcharges. These surcharges are tacked onto Medicare parts B and D premiums and can cost individuals substantial amounts of money. What you may not know is how these IRMAA charges are calculated. Understanding the calculations sheds light on how much IRMAA can cost you, as well as opens the gateway to finding strategies to avoid becoming subject to IRMAA. Fortunately, understanding how IRMAA is calculated is pretty simple.

Medicare premiums for part B and D are based upon your income. Individuals with higher incomes will pay more for their Medicare premiums. The income used by the government to calculate your premiums comes from your tax return from two years previous. You are placed in one of six brackets based upon your income. The first bracket pays no IRMAA and subsequent brackets pay IRMAA in increasing amounts. This can be seen in table 1.

Part B IRMAA is calculated by multiplying the average expenditure (which is the standard premium multiplied by 4) by the subsidy percentage assigned to a particular income bracket. The subsidy amounts can be found in table 2. The resulting answer is the total amount you will pay (standard premium plus IRMAA). If you want to see how much the IRMAA charge is alone, simply subtract the standard premium from the answer you just calculated.

Unfortunately, for Medicare part D, there seems to be no clear-cut answer on how the surcharges are calculated. Social Security.gov reports that “Once the IRMAA calculations are done, CMS notifies the Social Security Administration (SSA) so we can make IRMAA”. There is no further information provided on how the surcharges are calculated for Part D. Table 1 provides the updated rates provided by the government for 2021.

| Individual | Married Couple | Part B | Part D |

| < $88k | < $176k | $148.50 | Premium (varies) |

| $88k – $111k | $176k – $222k | $207.90 | Premium + $12.30 |

| $111k – $138k | $222k – $276k | $297.00 | Premium + $31.80 |

| $138k – $165k | $276k – $330k | $386.10 | Premium + $51.20 |

| $165k – $500k | $330k – $750k | $475.20 | Premium + $70.70 |

| >$500k | >$750k | $504.90 | Premium + $77.10 |

| IRMAA Brackets | Subsidy |

| No IRMAA | 25% |

| 1st Bracket | 35% |

| 2nd Bracket | 50% |

| 3rd Bracket | 65% |

| 4th Bracket | 80% |

| 5th Bracket | 85% |

That was a quick answer, if you want a slightly deeper dive into how IRMAA surcharges are calculated, read on.

A QUICK REFRESHER ON WHAT IRMAA IS

IRMAA is an acronym for, “the Income Related monthly Adjustment Amount.” What IRMAA does is increase the amount you are required to pay for Medicare part B and D based upon how much income you receive in retirement. These increased payments present themselves in the form of surcharges tacked onto the standard Medicare part B and D premiums. In other words, IRMAA requires Individuals who make more money to pay more for Medicare to help foot the Medicare bills for individuals who make less money. Whether or not you will be subject to IRMAA is entirely dependent upon your income in retirement.

HOW MEDICARE PART B IRMAA IS CALCULATED

To understand how IRMAA is calculated we first need to take a look at how much Medicare is expected to cost the nation per person. In 2021, the average expenditure for part B is set at $594.00 a month. In other words, the government expects that the overall national expense for Medicare Part B divided by the number of individuals enrolled in Medicare part B will result in an average cost of $594.00 per person per month.

Of course, $594.00 is not what retirees pay for their monthly Medicare premiums. In fact, the standard premium that most people can expect to pay in 2021 is about $148.50. Why the difference? The difference is because every retiree enrolled in Medicare receives a subsidy from the government that reduces their Medicare premiums. According to the Medicare Board of Trustees the Part B premium “is set at the level of about 25% of average expenditures for beneficiaries aged 65 and over”. So, if we take the 25% of the average expenditure ($594.00) we find that equals $148.50 ($594.00 x .25 = $148.50).

This information gives us a formula that we can work with to determine IRMMA surcharges.

That formula is as follows:

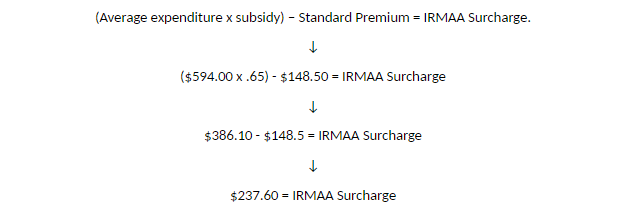

(Average expenditure x subsidy) – Standard Premium = IRMAA Surcharge.

The first piece of the equation that we need is the average expenditure. This is found by multiplying the current year’s standard Medicare part B premium by 4. We know this is true because the Medicare Board of Trustees has stated that the standard premium for part B is 25% or 1/4th of the Average expenditure. So for 2021, we take the standard premium of $148.50 and multiply it by 4 to get $594.00.

The second piece of information can be found be looking at the chart below. Simply find which IRMMA bracket you fall into based upon your income and plug the corresponding subsidy into the equation.

| IRMAA Bracket | Income Individual | Income Married Couple | Subsidy |

| No IRMAA | < $88k | < $176k | 25% |

| 1st Bracket | $88k – $111k | $176k – $222k | 35% |

| 2nd Bracket | $111k – $138k | $222k – $276k | 50% |

| 3rd Bracket | $138k – $165k | $276k – $330k | 65% |

| 4th Bracket | $165k – $500k | $330k – $750k | 80% |

| 5th Bracket | >$500k | >$750k | 85% |

The last part of the equation is the standard premium which we have already figured out and is readily available all over the web.

As an example, let’s say that you are a single individual who earns $140,000 a year. This puts you into the 3rd IRMAA Bracket. Using the equation:

This means that if you are a single earner making $140,000 a year, you will pay the standard premium of $148.50 plus an additional $237.6 in IRMAA every month, or a total Medicare Part B premium of $386.10 per month.

HOW MEDICARE PART D IRMAA IS CALCULATED

Unfortunately, unlike part B IRMAA, the Government has not told us how they calculate part D IRMAA.

Social Security.gov reports that “Once the IRMAA calculations are done, CMS notifies the Social Security Administration (SSA) so we can make IRMAA”. There is no further information provided on how the surcharges are calculated for Part D.

The government simply releases the information on how much the surcharges for each bracket will be annually. You can see the Part D Surcharges for 2021 in table 1 located at the top of this article.

WHAT IF I’M UNFAIRLY CHARGED IRMAA?

This is a real situation people find themselves in. Remember, the income upon which your Medicare premiums are based is taken from your tax return from two years prior. This can result in a situation where individuals are currently receiving a smaller income but are paying Medicare premiums as though they were making a large income. This situation often presents itself during the transition from working to retirement. If you find that you are incorrectly subject to IRMAA, you can submit a request for reconsideration of your IRMAA to the Social Security office. The Request process involves filling out and submitting an SSA-44 Form which can be found by clicking on this link.

IS THERE WAYS TO AVOID PAYING IRMAA?

There are ways to avoid becoming subject to IRMAA. Investment strategies such as investing in Roth accounts rather than tradition accounts, can play a role in lowering your Medicare premiums. At IRMAA Solutions we have developed a tool to help find the best investment strategies. This tool is our Medicare IRMAA Calculator Software. This Software allows you to accurately project future Medicare costs and experiment with investment strategies that will minimize Medicare costs while maximizing retirement income.

SUMMARY

In summary:

The Income Related monthly Adjustment Amount (IRMAA) is an additional surcharge that raises the amount higher income individuals will pay for Medicare. IRMAA applies to Medicare parts B and D.

To determine the Part B IRMAA surcharge simply multiply the current year’s Part B premium by 4 and then multiply that number by the subsidy (($148.50 x 4 = $594.00) ($594.00 x subsidy = surcharge)).

The Social Security Department has not released information regarding the way part D premiums are calculated. They simply release the surcharge amounts that will each income bracket will be subject too.

If you feel that you have incorrectly become subject to IRMAA, you can submit a request for reconsideration to the Social Security Department by filling out an SSA-44 Form.

If you’ve ever been hit with IRMAA surcharges, you’ve probably wondered what they were and why you had to pay them. No one likes to pay more than they have too, especially in retirement. Fortunately, By understanding how IRMAA is calculated, you can gain awareness of how much these surcharges can cost you, make smart plans that take these charges into account, and begin developing smart strategies to avoid becoming subject to IRMAA.