Impact of IRMAA on your Social Security benefit

In retirement when it comes to your health insurance there is only one option especially if you are no longer covered by creditable health coverage from an employer and that is Medicare.

Thankfully, Medicare is fantastic form of health coverage if you are properly insured and utilize the coverage prudently, but it, unfortunately, is not free.

With Medicare, there are co-pays, deductibles and even premiums that must be met and the bulk of these costs, Part B and D premiums, will be deducted from your Social Security benefits.

The higher your Medicare costs the lower your Social Security benefit.

What is IRMAA?

When you enroll into Medicare your income will determine how much your Part B and D premiums will be. The more income you have the higher those costs will be – this is IRMAA.

IRMAA is short for the Income Related Monthly Adjustment Amount.

What is Income for IRMAA?

The Code of Federal Regulations defines income for IRMAA as “modified adjusted gross income (MAGI) or everything on lines 2a and 11 of your 2021 IRS tax-form 1040”.

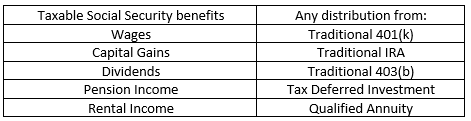

Some examples of your income that will be used for IRMAA are:

This type of income will also lead to 85% of your Social Security benefit being taxable.

What is the impact of IRMAA?

Medicare premiums are expected to inflate by 6.00% over the next 8 years while Social Security’s COLA is only projected to be 2.40% during the same time period

The greatest possible impact of IRMAA is the increased depletion of your Social Security over the course of your retirement as you will be able to see in the examples provided below:

Examples of what to expect from your Social Security benefit:

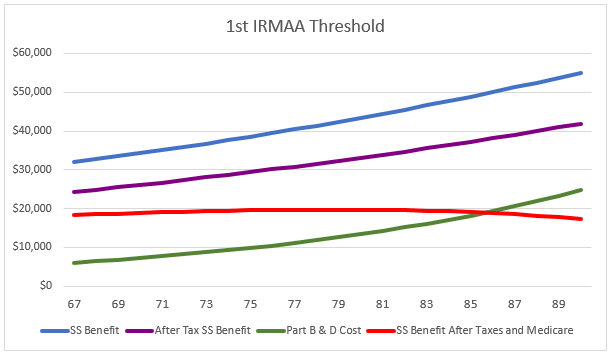

Example #1 – the 1st Threshold

Person A is 60 years old and plans on retiring at 67. They are earning $75,000 a year and would like to continue that throughout retirement.

Security’s Quick Calculator projects their benefit to be $31,188 when they retire.

Below is a chart detailing how taxes on Social Security, Medicare Part B and D premiums and being in the 1st IRMAA Threshold of IRMAA will impact their Social Security benefit through retirement.

Breakdown of the above chart:

- The Blue Line represents the believed Social Security benefit adjusting at the 2.40% COLA.

- The Purple Line represents the after-tax Social Security benefit.

- The Green Line represents IRMAA surcharges as well as Medicare Parts B and D premiums which are inflating by close to 6.00%.

- The Red Line represents what Person A can expect to actually get in Social Security benefits after their Medicare costs, taxes and IRMAA surcharges are deducted.

Impact of IRMAA

$154,711

$154,711 extra will be lost in Social Security benefits due to IRMAA

56% of their entire Social Security benefit will be consumed by taxes and Medicare

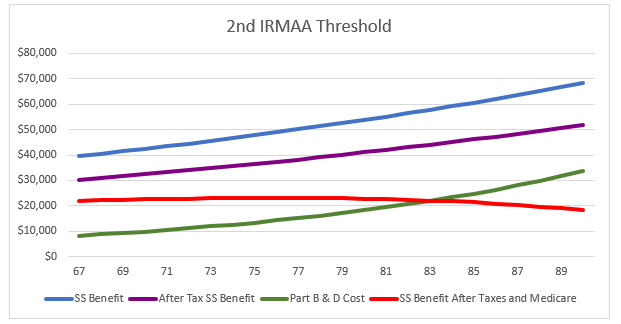

Example #2 – the 2nd IRMAA Threshold

Person A is 60 years old and plans on retiring at 67. They are earning $100,000 a year and would like to continue that throughout retirement.

Security’s Quick Calculator projects their benefit to be $39,540 when they retire which will inflate by the best possible Social Security COLA of 2.40% throughout retirement.

Below is a chart detailing how taxes, Medicare Part B and D premiums and being in the 2nd IRMAA Threshold of IRMAA will impact their Social Security benefit through retirement.

Breakdown of the above chart:

- The Blue Line represents the believed Social Security benefit adjusting at the 2.40% COLA.

- The Purple Line represents the after-tax Social Security benefit.

- The Green Line represents IRMAA surcharges as well as Medicare Parts B and D premiums which are inflating by close to 6.00%.

- The Red Line represents what Person A can expect to actually get in Social Security benefits after their Medicare costs, taxes and IRMAA surcharges are deducted.

Impact of IRMAA

$388,611

$388,611 extra will be lost in Social Security benefits due to IRMAA

58% of their entire Social Security benefit will be consumed by taxes and Medicare

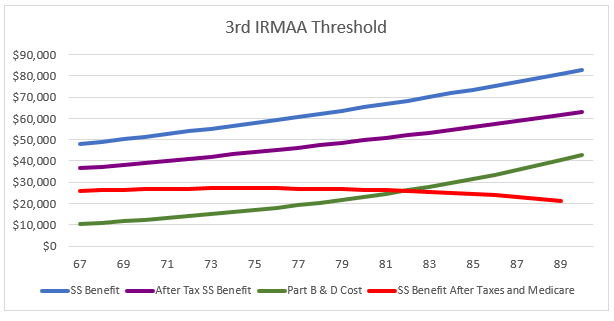

Example #3 – the 3rd IRMAA Threshold

Person A is 60 years old and plans on retiring at 67. They are earning $150,000 a year and would like to continue that throughout retirement.

Security’s Quick Calculator projects their benefit to be $47,928 when they retire which will inflate by the best possible Social Security COLA of 2.40% throughout retirement.

Below is a chart detailing how taxes, Medicare Part B and D premiums and being in the 3rd IRMAA Threshold of IRMAA will impact their Social Security benefit through retirement.

Breakdown of the above chart:

- The Blue Line represents the believed Social Security benefit adjusting at the 2.40% COLA.

- The Purple Line represents the after-tax Social Security benefit.

- The Green Line represents IRMAA surcharges as well as Medicare Parts B and D premiums which are inflating by close to 6.00%.

- The Red Line represents what Person A can expect to actually get in Social Security benefits after their Medicare costs, taxes and IRMAA surcharges are deducted.

Impact of IRMAA

$622,328

$622,328 extra will be lost in Social Security benefits due to IRMAA

60% of their entire Social Security benefit will be consumed by taxes and Medicare

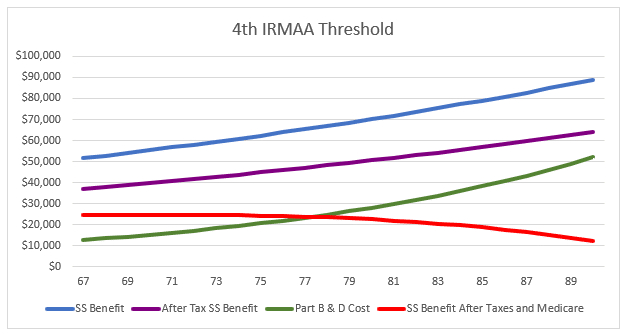

Example #4 – the 4th IRMAA Threshold

Person A is 60 years old and plans on retiring at 67. They are earning $180,000 a year and would like to continue that throughout retirement.

Security’s Quick Calculator projects their benefit to be $51,552 when they retire which is projected to inflate by the best possible Social Security COLA of 2.40% throughout retirement.

Below is a chart detailing how taxes, Medicare Part B and D premiums and being in the 4th IRMAA Threshold of IRMAA will impact their Social Security benefit through retirement.

Breakdown of the above chart:

- The Blue Line represents the believed Social Security benefit adjusting at the 2.40% COLA.

- The Purple Line represents the after-tax Social Security benefit.

- The Green Line represents IRMAA surcharges as well as Medicare Parts B and D premiums which are inflating by close to 6.00%.

- The Red Line represents what Person A can expect to actually get in Social Security benefits after their Medicare costs, taxes and IRMAA surcharges are deducted.

Impact of IRMAA

$856,229

$856,229 extra will be lost in Social Security benefits due to IRMAA

70% of their entire Social Security benefit will be consumed by taxes and Medicare

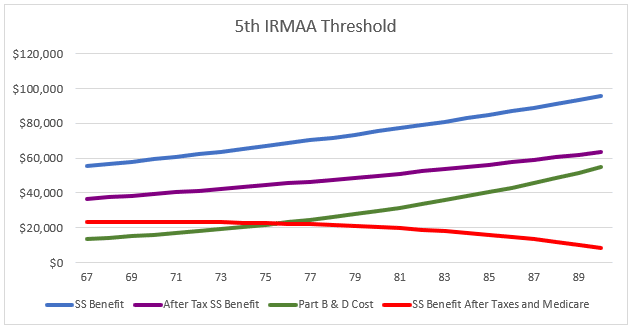

Example #5 – the 5th IRMAA Threshold

Person A is 60 years old and plans on retiring at 67. They are earning $500,000 a year and would like to continue that throughout retirement.

Security’s Quick Calculator projects their benefit to be $55,308 when they retire which is projected to inflate by the best possible Social Security COLA of 2.40% throughout retirement.

Below is a chart detailing how taxes, Medicare Part B and D premiums and being in the 4th IRMAA Threshold of IRMAA will impact their Social Security benefit through retirement.

Breakdown of the above chart:

- The Blue Line represents the believed Social Security benefit adjusting at the 2.40% COLA.

- The Purple Line represents the after-tax Social Security benefit.

- The Green Line represents IRMAA surcharges as well as Medicare Parts B and D premiums which are inflating by close to 6.00%.

- The Red Line represents what Person A can expect to actually get in Social Security benefits after their Medicare costs, taxes and IRMAA surcharges are deducted.

Impact of IRMAA

$934,134

$934,134 extra will be lost in Social Security benefits due to IRMAA

74% of their entire Social Security benefit will be consumed by taxes and Medicare

Avoiding IRMAA

The simplest way to avoid IRMAA is to create a source of revenue in retirement that is not recognized by the IRS.

This can be done by ensuring that revenue does not show up on lines 2a and 11 or your IRS tax form 1040.

Thankfully there are few options in accomplishing this and the two simplest ways are:

Roth Accounts:

Due to federal regulations with Roth Accounts you pay taxes on your contributions today.

This means no matter how much your investment grows over time when take a distribution from your savings there absolutely no tax you have to pay.

One of the simplest ways to invest using a Roth account is through your employer’s retirement plan. Contributions can be made automatically from your paycheck and in some cases your employer may match that contribution in that Roth account too.

Life Insurance:

With a permanent form of Life Insurance, a Cash Value within the policy will be created. Distributions from the Cash Value, if structed correctly, are considered to be loans which do not count as income and are not taxable.

The benefits of either Roth Accounts and/or Life Insurance

With distributions not being reported as income the possibility of your Social Security benefit being taxed is drastically lowered.

In fact, the only way that your Social Security benefit will be taxed is if half of the amount is greater than $34,000 for individuals or $44,000 for couple.

With your Social Security benefit not counting as income and any other revenue you generate from either a Roth Account or Life Insurance also not counting as revenue reaching IRMAA is most likely not a possibility.

The choice is yours:

Invest in tax-deferred vehicles like a Traditional 401(k) or IRA and there is a high probability that you will reach IRMAA in retirement or

Contribute to a Roth Account or Life Insurance and not only will drastically decrease that probability of reaching IRMAA you will take home even more of your Social Security benefit.

Your health is your greatest asset, the time to plan for it is today.