Every couple of years the subject of Social Security becoming insolvent or going bankrupt seems to grab the media and the nation’s interest and with good reason. The current Social Security system just happens to be, on paper, paying out almost more in terms of benefits than what it is receiving.

The logical conclusion is that Social Security has to be running out of money, but the reality is that it is not. In fact, thanks to legislative changes over the last few years from Congress and the financial industry’s willingness to never mention any of these changes, the Social Security program will actually, flourish in the very near future.

The legislative changes from Congress that you will never be told about – The 4 Rules of Retirement:

Rule #1: To receive your Social Security benefit you must also accept Medicare when eligible.

- Eligibility for Medicare is when you become 65 years-old or older AND you no longer have creditable health insurance through an employer or your spouse’s employer.

Failure to accept Medicare (Part A) results in the forfeiture of all Social Security benefits.

Rule #2: Your Medicare premiums have an extra tax on income through the Income Related Monthly Adjustment Amount or IRMAA.

- IRMAA is a surcharge on top of the current year’s Medicare Part B and D premiums for those who earn too much income.

Rule #3: The income to determine IRMAA just happens to be almost everything in your retirement plan.

- Social Security.gov defines income for IRMAA to be: “Your adjusted gross income plus tax-exempt interest” or everything on lines 2b and 11 of the 2020 tax form 1040.

Some examples of IRMAA income are: Social Security benefits, Wages, Capital Gains, Dividends, Pension and Rental Income, Interest and as any distributions from investments like a Traditional 401(k) or Traditional IRA.

Rule 4: Your Social Security benefit will pay, automatically, the bulk of your Medicare premiums and any costs from IRMAA.

With the regulations from Congress, the higher your Medicare premiums the lower your Social Security that will receive will be.

To illustrate how Medicare will save the Social Security program.

The Medicare Board of Trustees is projecting that Medicare premiums will inflate by at least 6.40% over the next 8 years.

During this same time, the Social Security Board of Trustees is projecting that the cost-of-living-adjustment (COLA), which is an annual benefit increase to keep ahead of inflation for beneficiaries, will be no higher than 2.40%.

With Medicare premiums inflating by twice as much the obligation that Social Security must pay out annually will decrease over time.

Here is an example of how Medicare will save Social Security:

According to MSN Money the average Social Security benefit being received for someone who is 65 years old is $1,321.00 a month. Today, the Medicare Part B premium is $148.50 a month while the national average Part D premium is $70.14 a month (including deductible).

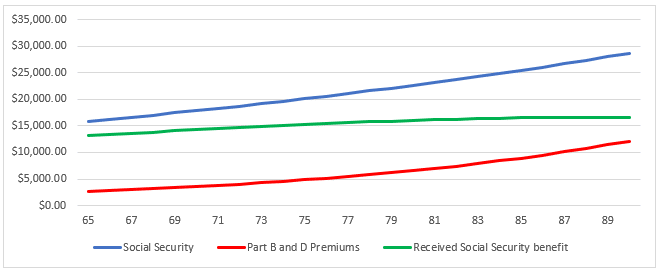

Below is a graph that details what a 65-year-old person can expect in terms of their Social Security benefit:

As it can been seen from the above graph, Medicare is consuming roughly 16.5% of this person’s Social Security benefit. By age 75 the percentage increases to over 24% and by age 85 it is 35%.

With each annual Medicare increase the burden of Social Security to pay out benefits decreases and with IRMAA the disparity is even larger.

How IRMAA furthers the ability of Medicare in saving Social Security:

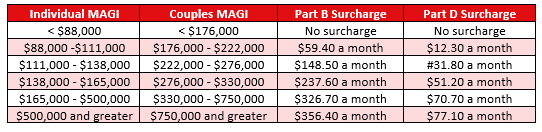

IRMAA is broken up into 6 brackets, below is a chart for 2021:

For those reaching the highest bracket their Medicare Part B premium will total $6,085 for the year. Their Part D premium will also have an added surcharge of $925.20 for a total of $7,973 in Medicare premiums in 2021.

According to Social Security.gov the greatest benefit someone can receive in 2021 is $3,895.00 a month which is projected to inflate by the COLA of 2.4%.

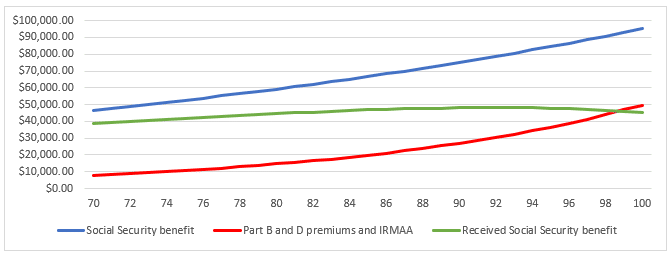

Below is a chart detailing what this person should expect to receive in Social Security benefits after the above 4 rules are applied:

Granted those in the highest bracket may not need Social Security, but again they will not receive what is expected, which helps Social Security even further.

The issue is further compounded if this person has a spouse who will receive only the “spousal” Social Security benefit which is half of theirs or $1,947.50 a month. Unfortunately for the spouse the full IRMAA surcharges are still applied.

As long as Medicare premiums inflate greater than what Social Security increases by through the COLA annually the burden of the Social Security program is lessened.

But how does Medicare save the U.S. Budget?

In 2015 Congress passed the Bi-Partisan Budget. On page 585 of this Act any surcharges due to IRMAA will be deposited into the “General Fund of the Treasury”.

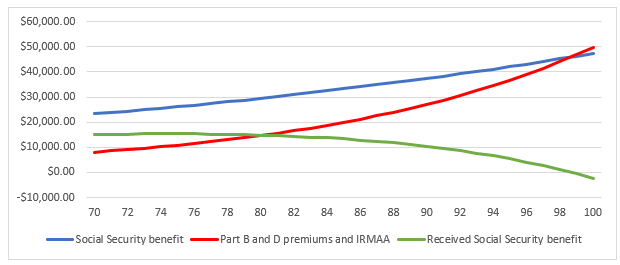

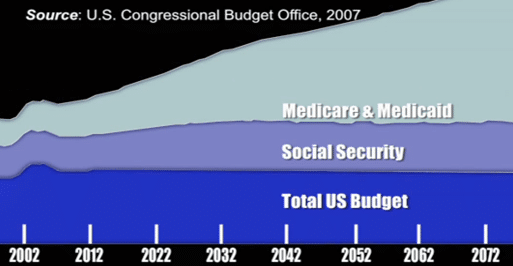

This may be why in 2007, the first year IRMAA was implemented, the Congressional Budget Office released the below graph which depicts how Medicare/Medicaid, Social Security and the total U.S. Budget will act through the next 4 decades:

As you can see as Medicare and Medicaid increase in costs both Social Security and the U.S. Budget remain constant.

The CBO may have known back then as the costs of healthcare increase the obligation of Social Security would be eased and the surcharges due to IRMAA would help Congress maintain the overall Budget.

The harsh reality is that Medicare will save Social Security as well help control the U.S. Budget…have you planned for this yet?