When you retire and become 65 years of age or older Medicare will be there for all of your health coverage needs. Thankfully, Medicare is a fantastic program, but it does come with costs as well as a surcharge or rather a tax on income too.

This surcharge, known as the Income Related Monthly Adjustment Amount or IRMAA, is for Medicare beneficiaries who generate “too much income” in a given year.

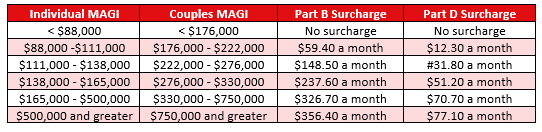

The surcharge ranges between 40% to 240% more than the current year’s Part B and D premium and the amount charged, if any, comes down to what your income is.

The IRMAA brackets and surcharges in 2021 are as follows:

What is the income that IRMAA uses?

With IRMAA the definition of income is slightly different from the definition that a Certified Public Accountant (CPA) or financial professional may have. According to Social Security income for IRMAA is:

“Your adjusted gross income plus any tax-exempt interest you may have.”

Or

Everything on lines 2 and 11 of the 2020 IRA tax form 1040.

Some examples of what generates income for IRMAA are:

Wages / Social Security benefits / Capital Gains / Pension & Rental Income / Dividends including muni’s / Any distribution from investment vehicles like Traditional IRA’s, 401(k)’s, 403(b)’s, SEP’s and Keogh’s.

If your income from these examples totals the amount in one of the IRMAA brackets, then, yes, you will reach IRMAA and you will have a surcharge.

Keep in mind that IRMAA surcharges, as well as the bulk of your Medicare premiums, are deducted from any Social Security benefit you are receiving.

Ultimately, IRMAA is a tax on your Medicare premiums as well as another tax on your Social Security benefit since you will be receiving less of it.

So, who will reach IRMAA?

If the current guidelines remain constant the answer may surprise you.

An example:

Person A is 55 years old today. They are earning $60,000 in wages and are placing 10.00% ($6,000 a year) into a Traditional 401(k) which is receiving a 5.00% rate of return annually. Their employer is matching their contribution at 5.00% and they have already saved $75,000 in their Traditional 401(k) too.

Person A. also, plans on retiring at age 70 to maximize their Social Security benefit, which according to Social Security’s Quick Calculator is projected to be, $45,954 a year. Social Security is also projecting a maximum cost of living adjustment (COLA) of 2.40%.

By age 72,5 when Person must make their required distribution their Traditional 401(K) will have a balance of roughly $386,000.00. Their RMD will total just over $15,000. If the COLA of Social Security remains at 2.40% they will also be receiving $48,000 a year too.

Thankfully they are under IRMAA, but by age 84 they will reach that first bracket. Their Medicare premiums will increase and more of their Social Security benefit will be consumed.

How to avoid IRMAA?

For Person A the solution is simple: instead of choosing a Traditional 401(k) for their retirement savings the could opt of a Roth 401(k) if their employer provides one.

The great aspect of a Roth 401(k) is that it is funded with after tax dollars. Granted they will have a smaller balance in their savings, but at age 84 and for their entire retirement, they will never reach an IRMAA bracket.

Roth distributions do not count as income.

So, who will reach IRMAA, well, from the example above anyone who happens to earn more in wages than Person A and who happens to have saved and invested like Person A.

Again, Person A:

- Earning $60,000 in wages.

- Investing $6,000 a year into a Traditional 401(k) plus a 5% company match.

- Already saved $75,000 at age 55 in their Traditional 401(k) that is receiving a 5% rate of return.

- Will start their Social Security at age 70.

To see how Medicare premiums and IRMAA impact Person A’s Social Security benefit click here.