Medicare’s Income Related Monthly Adjustment Amount or IRMAA for short, is simply a surcharge on top of the current year’s Medicare Part B and Part D premium for those who generate too income.

For those who are also receiving Social Security benefits the added surcharges are automatically deducted from any benefit too.

How IRMAA works?

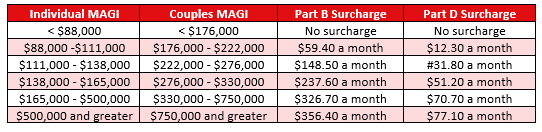

IRMAA consists of 5 different tiers or brackets which are based on income with each having its own surcharge.

In 2021 the IRMAA brackets are:

Once you are enrolled into Medicare the Centers for Medicare/Medicaid Services (CMS) will receive your tax returns from the IRS to determine your income.

For 2021 CMS will look at lines 2b and 11 of the IRS form 1040. This consists of your adjusted gross income plus any tax-exempt interest you have.

Please note: the IRS may provide CMS with any of your last 3-year tax returns. This makes IRMAA rear looking. This will be important to know later if in fact you believe you are in IRMAA incorrectly.

Due to the rule of looking at the past 3-year tax returns if you reach IRMAA in any one-year CMS may not look automatically at your next year’s tax return to adjust the IRMAA surcharge. If this does to happen you will be IRMAA until CMS re-adjusts IRMAA, which again can be in 3-years. It is entirely up to you to file an appeal with CMS under this circumstance.

Can you appeal IRMAA?

Thankfully, anyone who finds themselves in IRMAA has three options to reverse the decision. According to Social Security, which is responsible for informing you of any IRMAA decision, the options are:

- You can request a new decision if one of the below 5 incidents apply within the tax year that is being used in CMS’ decision:

- Your tax status changed due to a marriage, divorce, annulment, or worse case death of a spouse.

- You or your spouse stopped working or reduced your hours.

- There is a loss of income producing property due to an event or disaster that was out of your control.

- You/your spouse experience a scheduled cessation or termination, or reorganization of an employer’s pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

- A request for a new decision can be made if you have amended or corrected tax information.

- You can always appeal IRMAA. CMS states that they “will review the decision made to verify that a correct decision was made. A person who did not make the first decision will decide your case”.

These three reasons are why it is important to understand that CMS may look at your past 3-years of tax returns.

Some examples as to why you may want to appeal IRMAA:

- You enroll into Medicare at age 66. Prior to enrollment you were working full time and your salary exceeded any one of the IRMAA levels. You can request a new decision based on option #1 subset #2.

- You enroll into Medicare at age 65, but prior to enrolling you sold a property 2 years ago and your income was abnormally high that year. If CMS uses your tax return from that year you can request a new decision based on recent tax information.

- You are currently on Medicare, in IRMAA due to a large lottery winning (it can happen) from 2 years ago and CMS has not updated the decision. You can appeal IRMAA based on option #2 and even #3.

The great aspect of CMS and IRMAA is that there is an ability to appeal IRMAA at any time and you should, especially if your income fluctuates.

Keep in mind, if yo do appeal CMS will still withhold the surcharges until the decision is reached. If the new decision decreases your IRMAA bracket, according to Social Security, they “will correct the amounts and refund any incorrectly withheld premiums.”

Can you appeal IRMAA? Yes, you can, and you should.

In order to appeal IRMAA you will need to fill out form SSA-44 titled “Medicare Income-Related Monthly Adjustment Amount – Life Changing Event”. Click here for the form. You will also have provide your most current Federal Tax Form as evidence.

Once completed contact your local Social Security office for an appointment at (800) 772-1213.